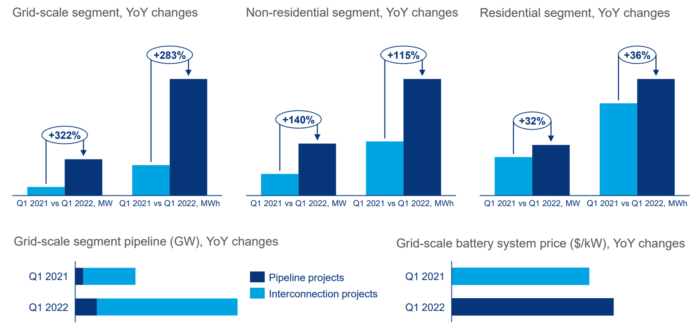

Wood Mackenzie, a Verisk company, has released the U.S. Energy Storage Monitor report. This report shows that the U.S. market for energy storage set a new record during the first quarter 2022. Grid-scale installations totaled 2,399 MWh. This is the highest Q1 record. Despite continued delays and procurement problems, the volume of grid-scale installations in the United States was four times that of Q1 last year.

“Quarter one of 2022 was the largest first quarter on record by far for grid-scale installations, a notable milestone since installations are typically back-weighted to the second half of the year,” says Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team. “The West Coast and Southwest regions continue to dominate for both standalone and hybrid systems.”

The grid-scale market continues to face risks despite significant growth. Market disruption caused by the anti-dumping/countervailing duties (AD/CVD), solar tariff investigation initiated in March by the Department of Commerce lowered projections of hybrid projects significantly in 2022 and to a lesser degree in 2023 as procurement stalled.

“The Biden Administration’s recent decision to pause AD/CVD solar tariffs for two years restores predictability to both the solar and energy storage markets,” states John Hensley, vice president of research and analytics at ACP. “With well over 50% of utility storage projects being paired with solar farms, this important executive action will help the energy storage market continue to accelerate.”

Residential storage also saw its strongest quarter yet with 334MWh installed during Q1, beating last year’s quarterly record of 283MWh in the fourth quarter.

“Despite challenging supply conditions continuing to suppress residential storage, the segment saw over 20,000 installations in a single quarter for the first time and we’re seeing large and small installers forge new vendor partnerships to help meet rising customer demand,” comments Chloe Holden, analyst with Wood Mackenzie.

By 2026, the residential storage segment is forecasted to grow by 5.7 GWh annually, with California’s Net Energy Metering (NEM) 3.0 expected to align with the California Public Utilities Commission’s December 2021 proposed decision with implementation now on a delayed timeline.

Non-residential storage is expected to grow by 1 GW annually between 2026 and 2026. However the overall market forecast has been reduced in part due to AD/CVD related procurement delays. “A meaningful share of residential solar-plus-storage projects not yet procured are being pushed to 2023, which has impacted paired storage,” Holden adds.

In the first quarter 2022, the U.S. energy storage market grew by 955 MW and 2,875MWh in all segments.

“California continues to dominate the sector, with the Valley Center and Slate projects taking the top two spots for largest projects installed in Q1,” Witte concludes. “We also saw more than 90 MW of storage come online outside the top seven states, including projects in Oregon and Alaska.”